First Home Buyers Guide

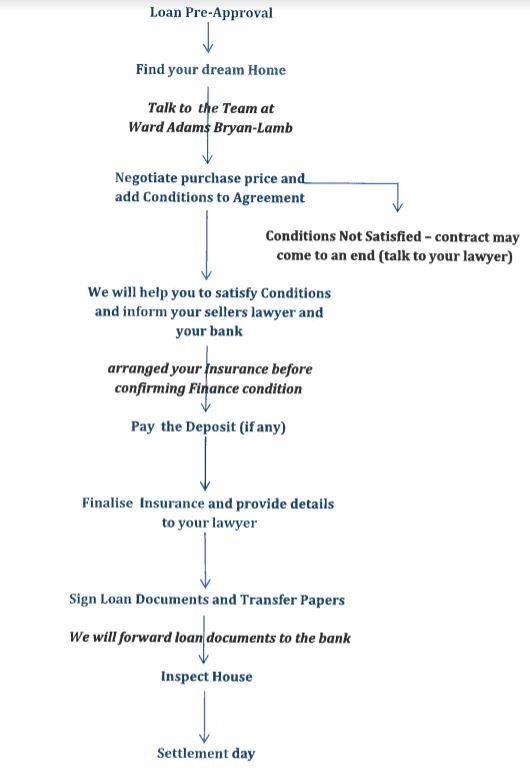

Congratulations! You have decided to buy your first home. Purchasing a home for the first time can be overwhelming and the process sometimes hard to comprehend. We, at Ward Adams Bryan-Lamb have created a simple guide to help you with your big purchase.

1. Before entering into an Agreement to purchase your home

Lending Approval

You should always approach your bank or mortgage broker to find out about their lending requirements and if possible obtain pre-approval for your lending. This will give you an idea of how much you can borrow before you start looking for your dream home.

KiwiSaver

Give the team at Ward Adams Bryan-Lamb a call if you are planning to use 'KiwiSaver first-home deposit subsidy' and KiwiSaver first-home withdrawal. The 'first-home deposit subsidy is administrated by Housing NZ. These funds do not get paid until your settlement date (the day you pay for your home) so while they make up part of your total finance available to you to buy your first home, they should not be included in the cash you have available to pay as a deposit under the Agreement. We can discuss this with you prior to you signing the Agreement. The KiwiSaver first-home withdrawal is administered by your Scheme provider.

We can help you with your KiwiSaver applicationThe Offer Process

When you have found your dream home, contact Ward Adams Bryan-Lamb before signing the Sale and Purchase Agreement. Often, the Sale and Purchase Agreement goes back and forth between you and the seller several times before an agreement is reached. It really helps at this stage to have professional advice —we at Ward Adams Bryan-Lamb will advise you on your rights and obligations under the Contract and discuss various aspects of the property and conditions you way include in the Agreement to protect your interests. Some conditions you may want to include in the Agreement are;

- Finance

- LIM Report - Land Information Memorandum contains information

about what building

consents have been applied for,

geographical and planning information regarding the property.

- Builder's report

- Registered valuations (this may be required by your bank)

- Insurance - especially if you are purchasing an older home

See the team at Ward Adams Bryan-Lamb before you sign on the dotted line.

If you are buying an older home (built prior to 1960's), check with your chosen Insurance Company as soon as possible if they will insure the property. Home insurance must be in place before your bank releases any loan monies and so it is a good idea to have 'approval of insurance' as one of your conditions. Your lawyer will discuss with you these and other conditions.

You can also

negotiate how much deposit to pay (this will be payable when your agreement

becomes unconditional).

Usually people pay between 5 — 10% of the purchase price or you may prefer not

to pay a deposit and pay the whole purchase price on Settlement day.

If the seller accepts your offer, they will also sign the agreement and it becomes a contract.

Your offer should always be conditional on finance acceptable to you

2. After you have signed your Agreement to Purchase your home

Where the contract has conditions (such as finance or LIM report) it is known as a conditional contract. When all conditions are satisfied, the contract becomes unconditional and you have now committed to purchasing your first home. Your lawyer will help you in satisfying the conditions in the Agreement, and if the conditions are not able to be satisfied, the contract may come to an end.

Once all conditions are satisfied, the deposit (if any) would be payable to the real estate agent (or to the sellers lawyers if it's a private sale) and this will be released to the seller's lawyer after 10 working days or sooner if agreed by the seller and you. The balance of the purchase price is payable on settlement date (the day you pay for the property and the title is transferred into your name).

At this stage your lawyer may also talk to you about establishing a Trust, other ownership options and making your Wills.

Loan

Talk to your Bank or

mortgage broker and finalise your loan arrangements. Your lawyer will forward a

copy of your Sale and Purchase Agreement to your Bank and advise them that the Agreement is unconditional and confirm the

settlement date. The bank will send your loan documents to your lawyer for

signing. Your lawyer will arrange a

meeting with you to sign all bank documents and transfer documents (so the

property can be transferred into your

name on settlement date).

Insurance

As mentioned above, home insurance must be in place before your bank releases any loan monies on settlement day. Banks require full replacement cover (your home will be rebuilt to its original specifications in the event of a total loss) so it is a good idea to arrange this prior to signing your loan documents. Most Banks offer house and content insurance and they will be able to give you a price for this. You can compare this with other insurance companies before deciding which Company you prefer.

Home Inspection

Always do a home inspection on the house before settlement day

After you have fulfilled all

your conditions and before settlement day, go and inspect the house you are purchasing.

If there is any damage and anything that requires fixing, let the real estate

agent, your lawyer or the seller know.

Settlement Day

We are nearly there. There is no set time when you can move into your new home as it depends on when the bank transfers funds to your solicitor and when the seller's lawyer is ready to settle. Your lawyer will contact you as soon as your property has been paid for and for you to collect the keys from either their office or the real estate agents office.

We hope the information provided will help you to understand the purchase process. Give Sandy Gilmete a call on (03) 2182833 if you have any questions or you need someone to look through your Agreement before you sign it.